Non Allowable Expenses For Corporation Tax Malaysia

Our malaysia corporate income tax guide.

Non allowable expenses for corporation tax malaysia. Malaysia corporate taxes on corporate income last reviewed 01 july 2020. Legal and professional fees. Effective ya 2013 the amount of r r costs that qualify for tax deduction as a business expense is capped at 300 000 for every relevant three year period. 50 allowable tax incentives.

It is frequently unclear whether a certain tax expense might qualify as a tax deduction or not. Other allowable business expenses. Export allowances business expenses. Knowing what expenses are not tax deductible might help company to minimise such expenses.

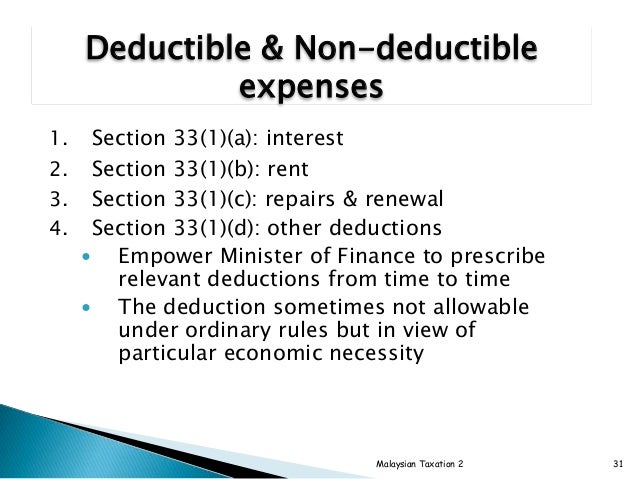

Expenses that are. Interest expense is allowed as a deduction if the expense was incurred on any money borrowed and employed in the production of gross income or laid out on assets used or held for the production of gross income. Exchange loss arising from transactions that are non trade or capital in nature. Legal fees are usually allowable and this includes costs of chasing debts defending trademarks preparing legal agreements.

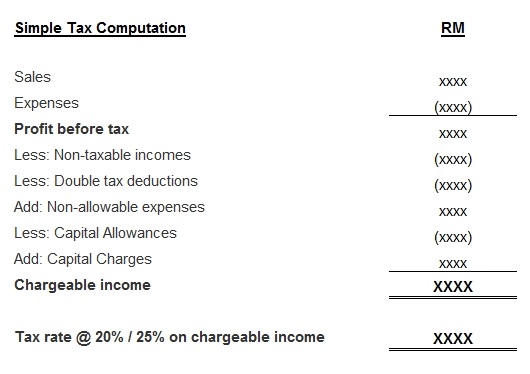

6 5 legal expense incurred by a landlord. Fortunately there are many deductible tax expenses that exist so you may be surprised that your tax expense of choice qualifies for a tax deduction. 2 tax treatment of business expenses i p 3 tax treatment of business expenses q r 4 tax treatment of business expenses s z for more information on how to make tax adjustments such as adding back non deductible business expenses to arrive at the income that is chargeable to tax please refer to preparing a tax computation. B annual general meeting expenses.

Malaysia offers a wide range of tax incentives for the promotion of investments in. The current cit rates are provided in the following table. The proportion of interest expense will be allowed against the non business income. Mosque building fund zakat.

6 4 income tax returns a cost of filing of tax returns and tax computations. Adjusted income from business source is derived from gross income after deduction of business expenses such as. For both resident and non resident companies corporate income tax cit is imposed on income accruing in or derived from malaysia. 6 3 annual corporate filings and meeting expenses a secretarial fees.

To the special commissioners of income tax and the courts. Expenses incurred prior to commencement of business however revenue expenses incurred 1 year before the accounting year in which the company earns its first dollar of business receipt are tax deductible from ya2012 onwards fixed assets written off. A company or. Staff entertaining is an allowable expense for company tax purposes whereas client entertaining may be an allowable expense and a portion may be disallowed for company tax purposes.

B cost of appeal against income tax assessment i e. Allowable business expenses. Nondeductible tax deductions expenses.