Non Allowable Expenses Malaysia Tax

Keep all business records supporting documents for deductions reliefs and rebate for a period of 7 years.

Non allowable expenses malaysia tax. Cost of acquisition of goodwill amortisation of goodwill is not deductible as these expenses are capital in nature. 6 july 2006 issue. The following conditions must be met before any deductions are made. Capital allowance tax depreciation on industrial buildings plant.

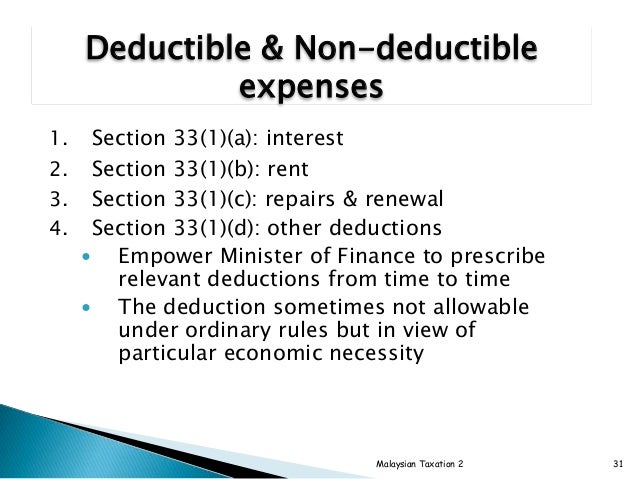

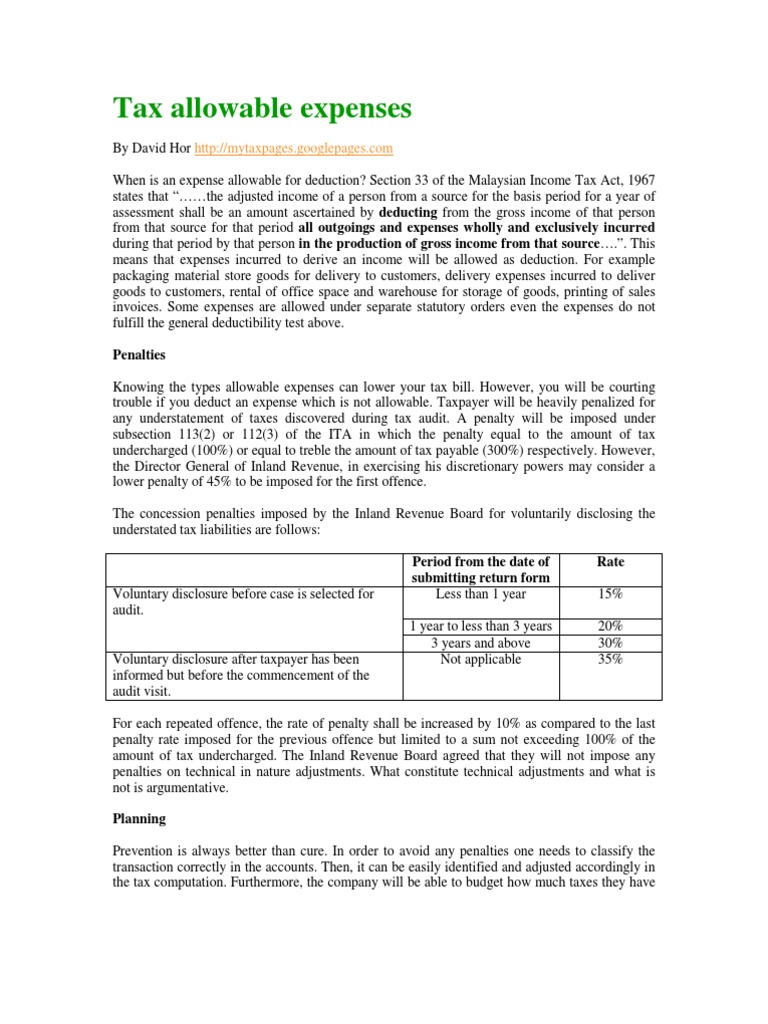

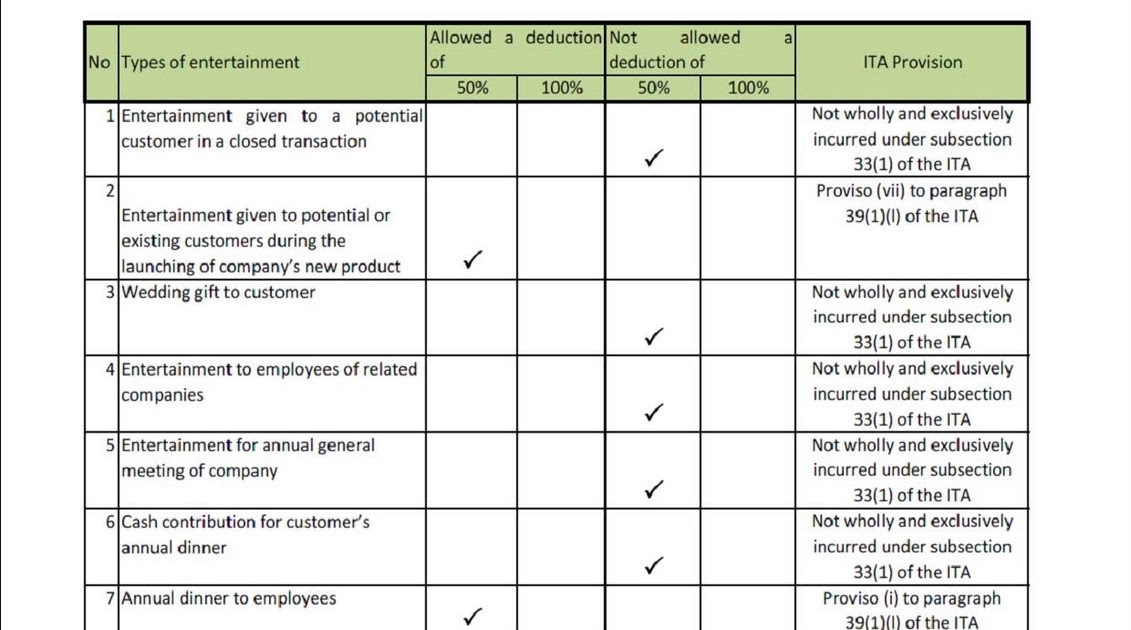

Nondeductible tax deductions expenses. A translation from the original bahasa malaysiatext page 4 of 5 6 1 debt collection legal and other expenses incurred by a person in the collection of non trade debts and loans of a capital nature. Entertainment expense if the expenditure does not fall within the definition of entertainment. It is frequently unclear whether a certain tax expense might qualify as a tax deduction or not.

6 2 renewal of loan a legal expenses incurred by a trading or commercial company. The expense of rm10 000 incurred by megah jaya sdn bhd is an entertainment expense under section 18 of the ita. Fortunately there are many deductible tax expenses that exist so you may be surprised that your tax expense of choice qualifies for a tax deduction. Effective ya 2013 the amount of r r costs that qualify for tax deduction as a business expense is capped at 300 000 for every relevant three year period starting from the year in which the r r costs are incurred.

Allowable and not allowable company expenses for tax purposes 3 by tejutax sep 10 2014. Knowing what expenses are not tax deductible might help company to minimise such expenses. Malaysia date of issue. And if you deduct an expense that doesn t qualify you might be faced with a tax notice or tax audit.

The expenses must be revenue in nature this means that the expenses are incurred in the normal day to day operations of the company. You can claim tax deduction for expenses that are wholly and exclusively incurred in the production of income. To submit the income tax return form by the due date. Prior to ya 2013 the cap was 150 000 for every relevant three year period.

Malaysia corporate deductions last reviewed 01 july 2020. Certain expenses have often been refused a tax deduction even though for businessman they are regarded as necessary business costs. The following are more common non allowable expenses. Income attributable to a labuan business.

For petroleum operations by virtue of section 13 1 a to j of ppta for the purpose of ascertaining the adjusted profit of a company in an accounting period deductions shall not be allowed in respect of some disbursements or payments. Example 1 megah jaya sdn bhd held an annual dinner for its employees and incurred a cost of rm10 000.