Partnership Tax Computation Format Malaysia

Tax rate of company.

Partnership tax computation format malaysia. Company tax computation format 1. This page is also available in. Melayu malay 简体中文 chinese simplified taxation for limited liability partnership llp in malaysia. The deadline for filing your income tax returns form in malaysia varies according to what type of form you are filing.

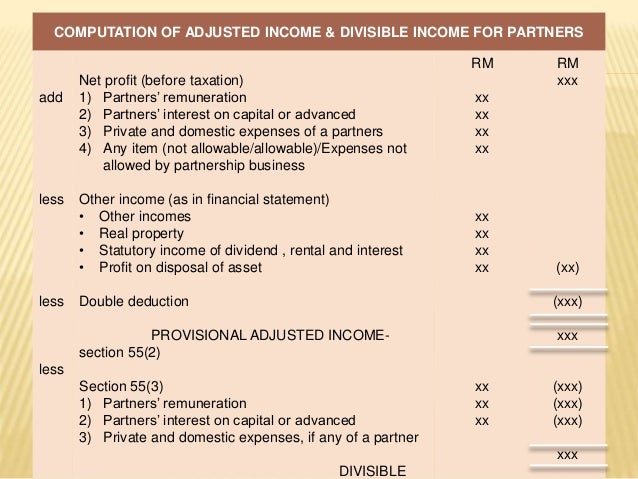

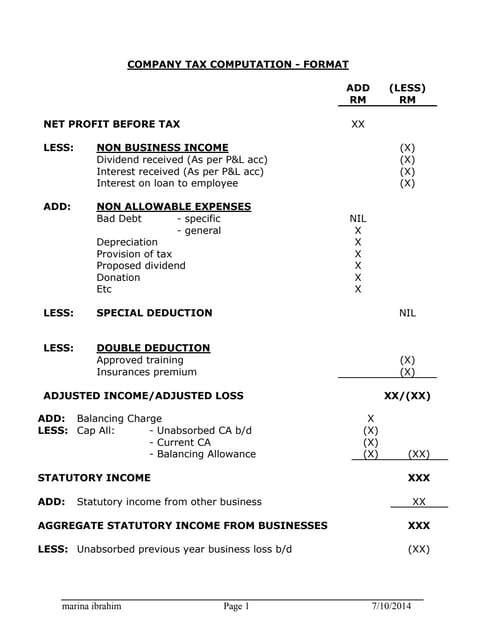

Company tax computation format add less rm rm net profit before tax xx less. Partnership tax comp slide no. Keep all business records supporting documents for deductions reliefs and rebate for a period of 7 years. Corporate income tax in malaysia is applicable to both resident and non resident companies.

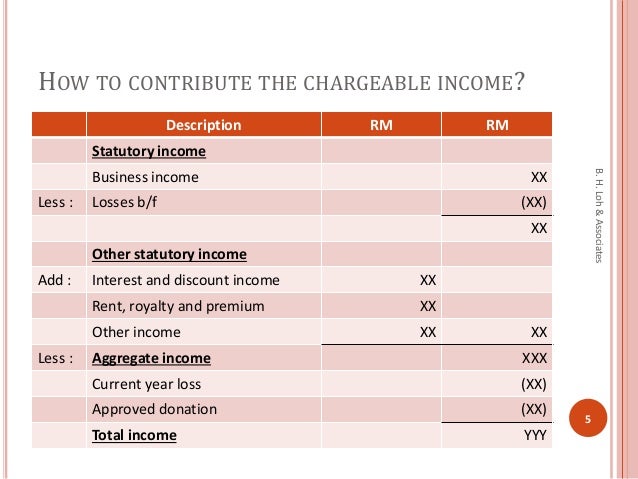

To submit the income tax return form by the due date. Therefore the partners are liable for their profits under personal income tax regulations the partners are taxed on their chargeable income at rates ranging from 2 to 26 after the deduction of tax relief. A tax computation is a statement showing the tax adjustments to the accounting profit to arrive at the income that is chargeable to tax. Llp have a similar tax treatment like company where chargeable income from llp will be taxed at the llp level at tax rate of 24 generally.

Example of tax computation format would be. The tax rate for sole proprietorship or partnership will follow the tax rate of an individual. Posts atom 2link back to. Blog archive 2010 1 february 1 partnership tax comp slide no.

Tax adjustments include non deductible expenses non taxable receipts further deductions and capital allowances. For the be form resident individuals who do not carry on business the deadline for filing income tax in malaysia is 30 april 2020 for manual filing and 15 may 2020 via e filing. Posted by 2link dot com at 6 57 pm no comments. These tax incentives appear in various forms such as exemption on income extra allowances on capital expenditure incurred double deduction of expenses special deduction of expenses preferential tax treatments for promoted sectors exemption of import duty and excise duty etc.

If there is any change in name please indicate the former name in parenthesis. Business records include profit and loss account balance sheet sales records. Non allowable expenses drawings cogs x holiday leave passage x bad debt specific nil general x loan to directors employees x. 2 income tax no.

In the boxes provided. Tax treatment of llp. Partnership tax computation monday february 1 2010. Malaysia offers a tax friendly environment with significantly low income tax the incomes are earned by the individuals and not by the partnership.

Non business income x dividend received as per p l acc x interest received as per p l acc x interest on loan to employee x add.

%202.png)