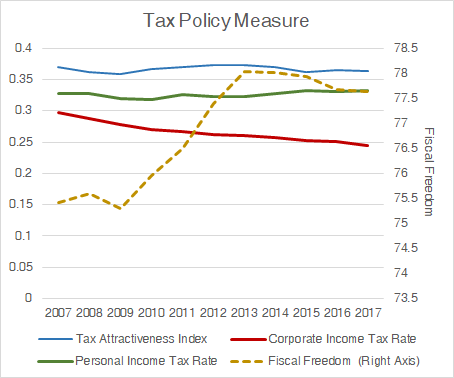

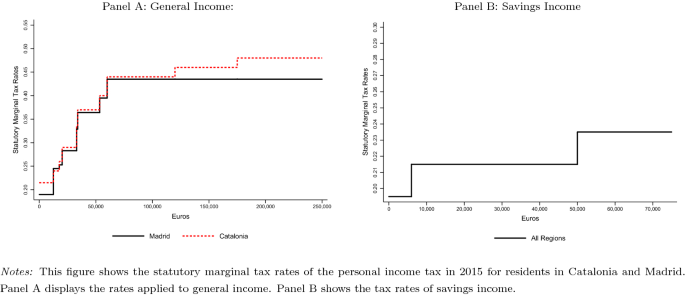

Personal Income Tax Rate 2015

Taxes on director s fee consultation fees and all other income.

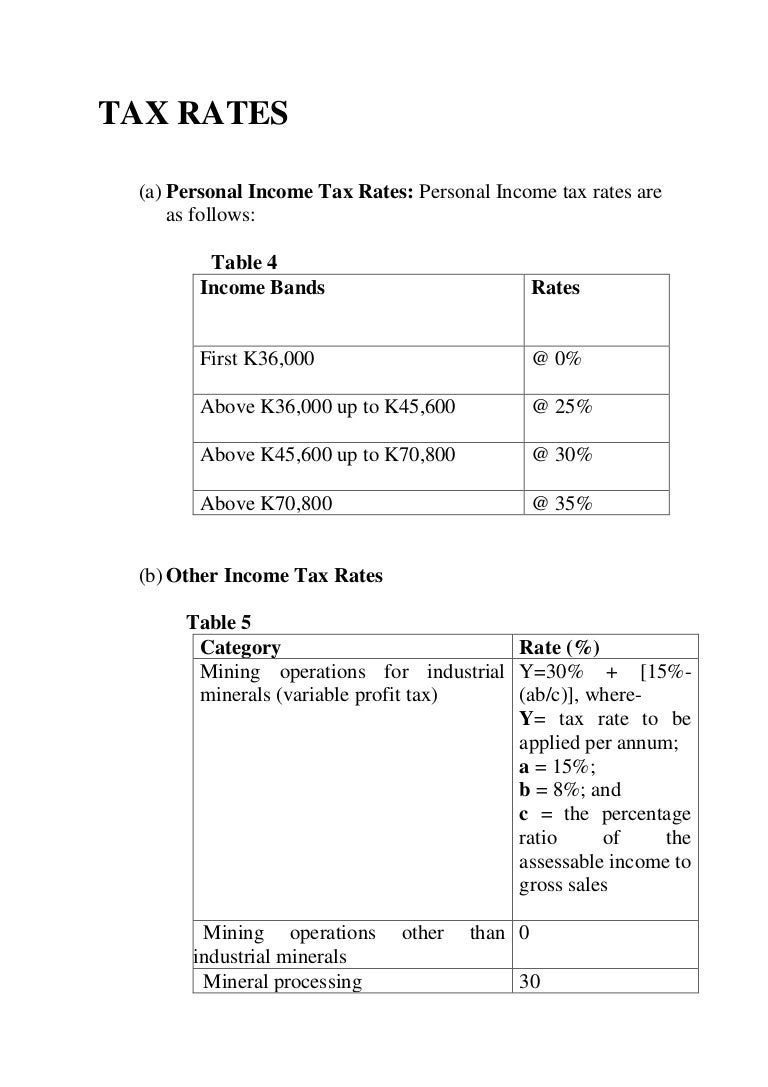

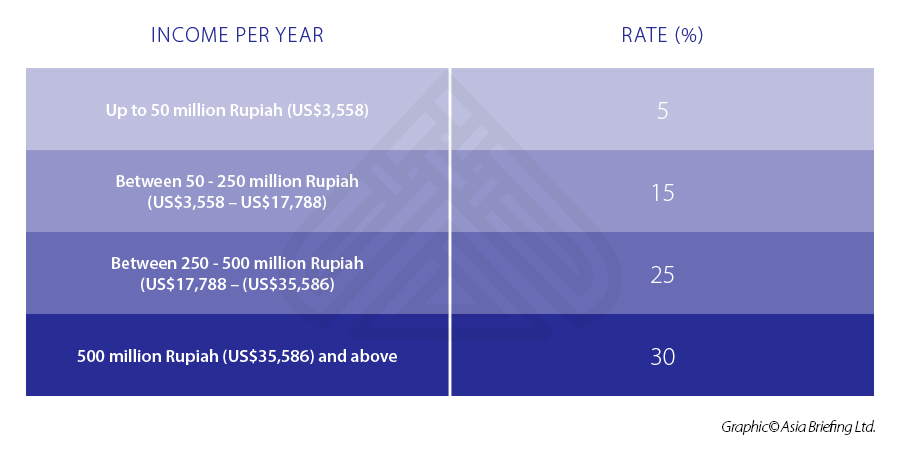

Personal income tax rate 2015. The tax rate applicable to a married couple or individuals in a swiss registered partnership is the rate applicable to 50 of their combined income so called splitting. Tax rates marginal income tax rates for 2015 and 2016 personal income tax rates for canada and provinces territories for 2015 and 2016. E tax guide e tax guide simplification of claim of rental expenses for individuals 5 jan 2015. Resident tax rates for 2015 16.

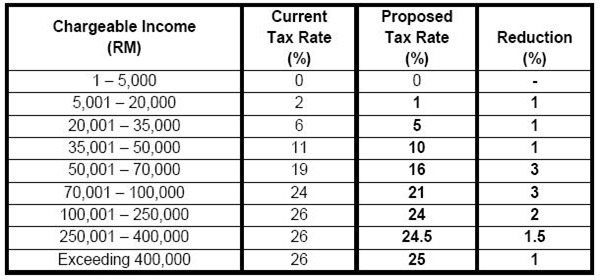

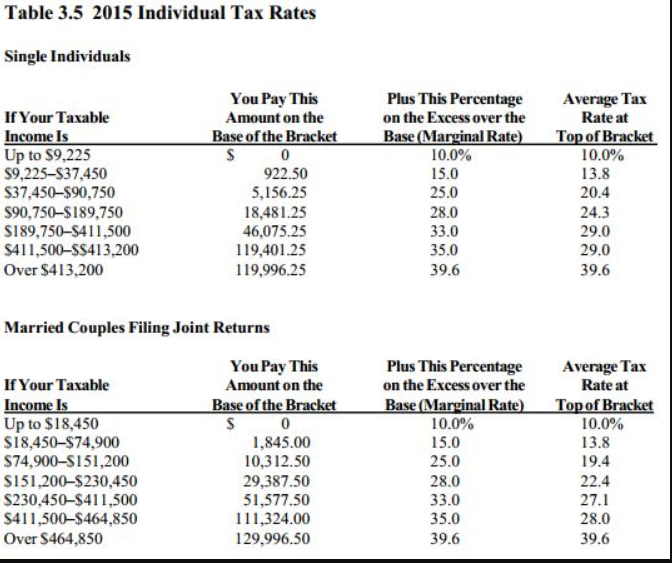

If you are looking for 2014 tax rates you can find them here. 2015 income tax brackets. In 2015 the income limits for all brackets and all filers will be adjusted for inflation and will be as seen in table 1. Tax administration diagnostic assessment tool tadat association of tax authorities in islamic countries.

Individual income tax rates for prior years. Jadual average lending rate bank negara malaysia seksyen 140b. These rates show the amount of tax payable in every dollar for each income bracket for individual taxpayers. The amount of tax you owe depends on your filing status and income level.

The top marginal income tax rate of 39 6 percent will hit taxpayers with taxable income of 413 200 and higher for single filers and 464 850 and higher for married filers. National insurance contribution thresholds. Pengiraan rm kadar cukai rm 0 2500. 19c for each 1 over 18 200.

The amount of income tax and the tax rate you pay depends on how much you earn and your circumstances. Bands of taxable income and corresponding tax rates. Tax on this income. Income tax rates for non resident individuals 5 jun 2015.

This is to maintain parity between the tax rates of non resident individuals and the top marginal tax rate of resident individuals. Choose your province or territory below to see the combined federal provincial territorial marginal tax rates. The federal income tax has 7 tax brackets. From ya 2017 the tax rates for non resident individuals except certain reduced final withholding tax rates has been raised from 20 to 22.

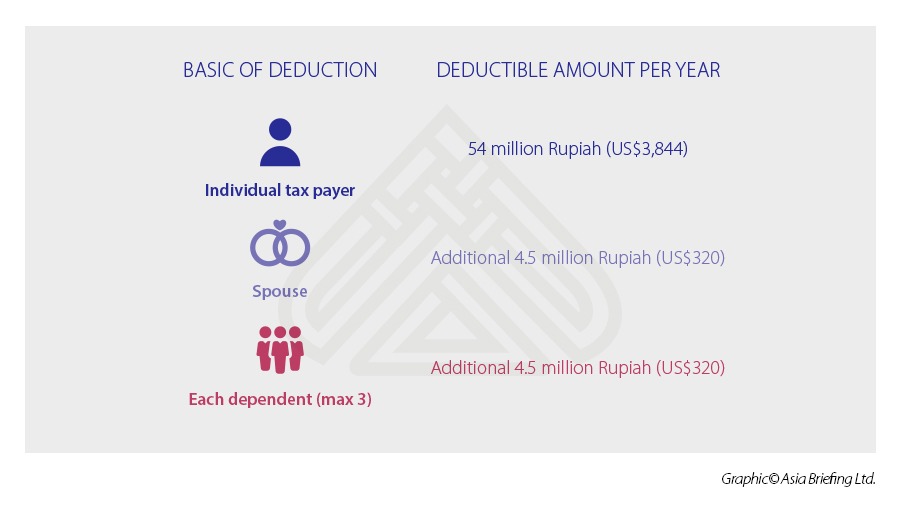

Tahun taksiran 2015. Class 1 national insurance contribution rates 2015 16. If you need help applying this information to your personal situation phone us on 13 28 61. The tax rate applicable to single widowed divorced or separated individuals living with a dependant child or adult is the rate applicable to 50 of the income.

Video tax tips on atotv external link. 15 jun 2015 content. Individual income tax rates for prior years. Claim for tax treaty exemption for dependent personal services rendered by employee.