Personal Income Tax Rate 2019

For ya 2017 a.

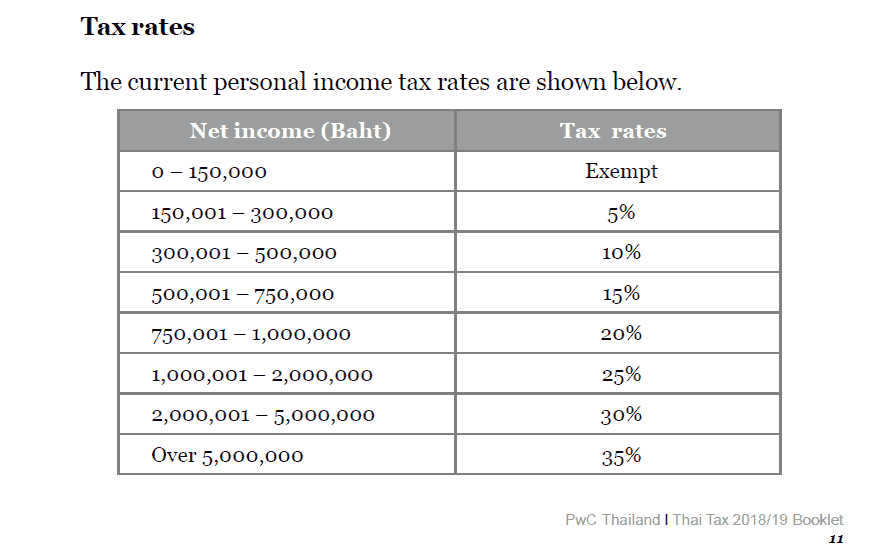

Personal income tax rate 2019. Income tax brackets and rates. Non resident individuals pay tax at a flat rate of 30 with. Tax on this income. What is a tax exemption.

Malaysia personal income tax guide for 2020. What is chargeable income. What is a tax deduction. You will be treated as a tax resident for a particular year of assessment.

Tax relief for year of assessment 2019 tax filed in 2020 chapter 5. On the first 5 000 next 15 000. 29 250 plus 37c for each 1 over 90 000. Income tax rates depend on an individual s tax residency status.

62 550 plus 45c for each 1 over 180 000. What is tax rebate. Calculations rm rate tax rm 0 5 000. 32 5c for each 1.

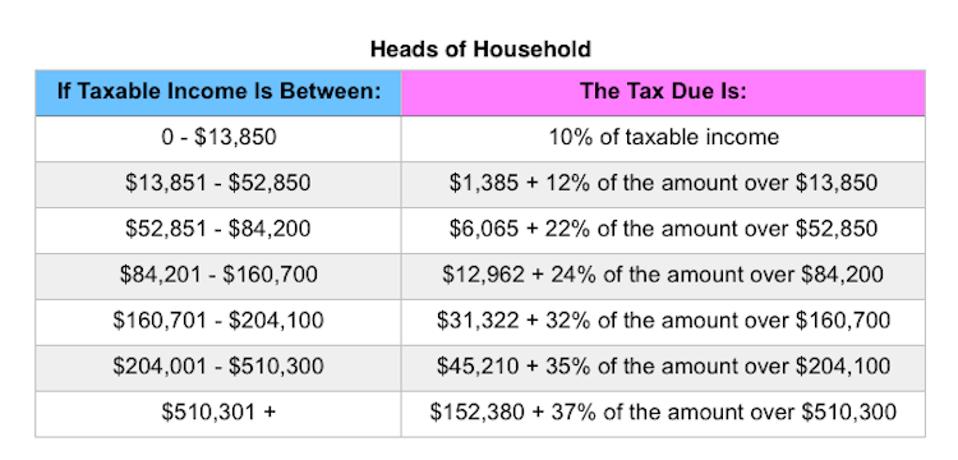

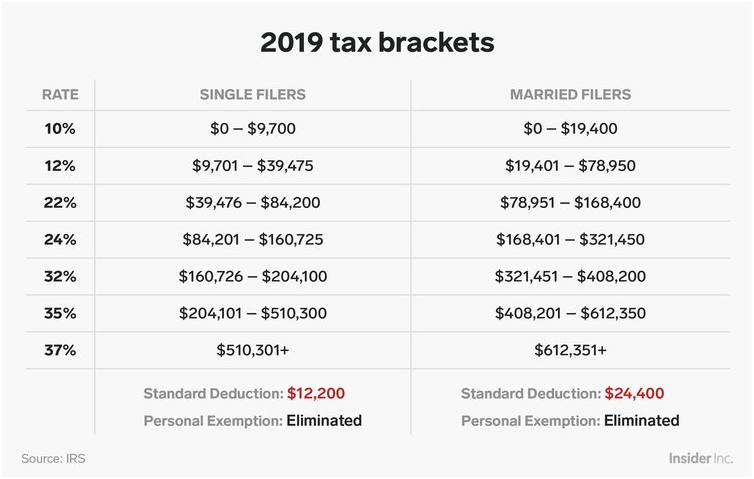

Malaysia personal income tax rate. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 510 300 and higher for single filers and 612 350 and higher for married couples filing jointly. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first rm5 000 to a maximum of 30 on chargeable income exceeding rm2 000 000 with effect from ya 2020. Tax rates for year of assessment 2019 tax filed in 2020 chapter 6.

On the first 2 500. In 2019 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows tables 1.