Personal Income Tax Rate Canada

This page provides canada personal income tax rate actual values historical data forecast chart statistics economic calendar and news.

Personal income tax rate canada. Personal income tax rates. Make a tax payment get information on paying by instalments paying arrears and payment arrangements. More personal income tax. 2020 includes all rate changes announced up to july 31 2020.

The federal tax brackets and personal amount are increased for 2020 by an indexation factor of 1 019. Calculate the tax savings your rrsp contribution generates. Tax rates marginal personal income tax rates for 2020 and 2019 2020 and 2019 tax brackets and tax rates canada and provinces territories. The personal income tax rate in canada stands at 33 percent.

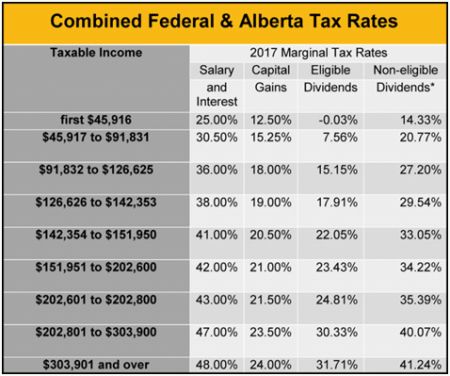

View the current and previous years tax rates for individuals. For 2019 and later tax years you can find the federal tax rates on the income tax and benefit return. This is to maintain parity between the tax rates of non resident individuals and the top marginal tax rate of resident individuals. Interest and ordinary income 49 80 capital gains 24 90 canadian eligible dividends 31 44 canadian non eligible dividends 44 63.

Taxes on director s fee consultation fees and all other income. You will find the provincial or territorial tax rates on form 428 for the respective province or territory all except quebec. Understand your notice of assessment noa and find out how to get a copy. 2019 includes all rate changes announced up to june 15 2019.

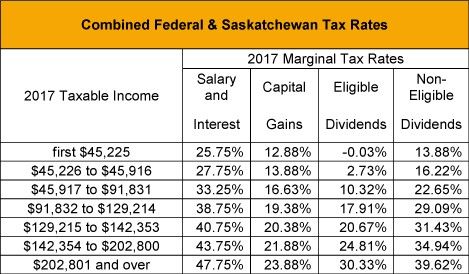

Please read the article understanding the tables of personal income tax rates. From ya 2017 the tax rates for non resident individuals except certain reduced final withholding tax rates has been raised from 20 to 22. If it is not enacted the following rates will apply to taxable income above cad 214 368. Canada federal 2020 and 2019 tax brackets and marginal tax rates income tax act s.

Canadian provincial corporate tax rates for active business income. Choose your province or territory below to see the combined federal provincial territorial marginal tax rates. The rates assume that british columbia will enact its proposed new top bc income tax rate of 20 5 on taxable income exceeding cad 220 000 starting 1 january 2020. Canadian corporate tax rates for active business income.