Personal Tax Rate 2019

The legislation is here.

Personal tax rate 2019. 54 097 plus 45c for each 1 over 180 000. What is chargeable income. On the first 2 500. Automatic extension of 2018 19 tax payment deadlines for 3 months.

Ya 2017 for ya 2017 a personal tax rebate of 20 of tax payable up to maximum of 500 is granted to tax residents. For ya 2019 a personal tax rebate of 50 of tax payable up to maximum of 200 is granted to tax residents. Tax rates for year of assessment 2019 tax filed in 2020 chapter 6. Calculations rm rate tax rm 0 5 000.

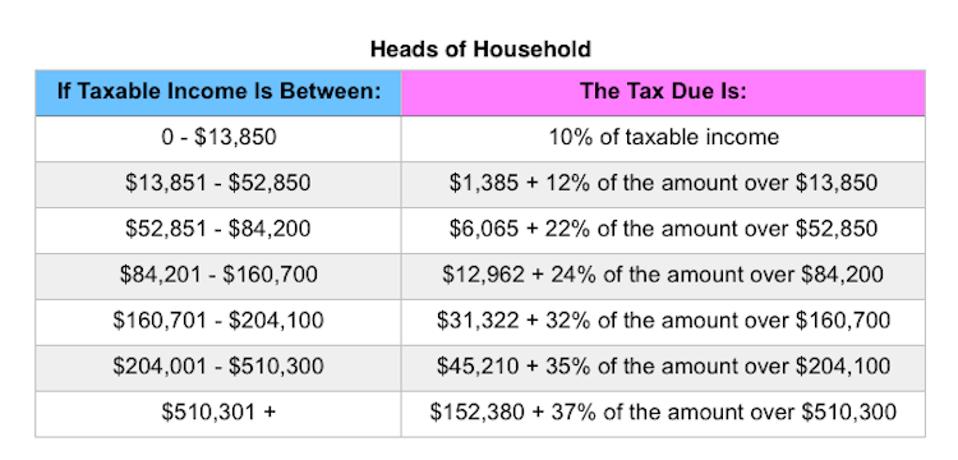

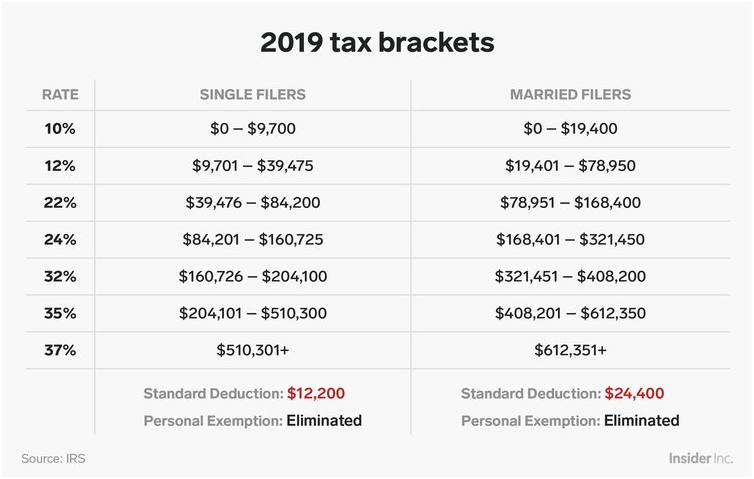

3 572 plus 32 5c for each 1 over 37 000. The 2018 budget announced a number of adjustments to the personal tax rates taking effect in the tax years from 1 july 2018 through to 1 july 2024. In 2019 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows tables 1. Personal circumstances 2020 2019 2018 2017 2016 single or widowed or surviving civil partner without qualifying children.

What is a tax exemption. Tax on this income. Tax exemptions in respect of relief measures under the anti epidemic fund 2020 21 budget concessionary measures relief measure. Tax relief for year of assessment 2019 tax filed in 2020 chapter 5.

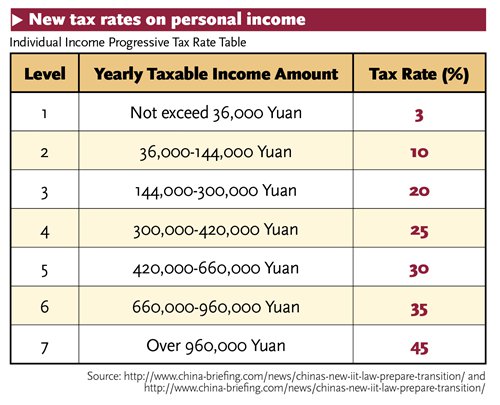

Band taxable income tax rate. On the first 5 000 next 15 000. The 2019 budget proposed measures contained an increase in the low and middle income tax offset see details below. Income tax brackets and rates.

Malaysia personal income tax guide for 2020. What is tax rebate. Rates and bands for the years 2016 to 2020. Personal tax rebate for ya 2019 as part of the bicentennial bonus all tax resident individuals will receive an income tax rebate of 50 of tax payable up to a cap of 200 for the year of assessment ya 2019.

19c for each 1 over 18 200. What is a tax deduction.