Private Retirement Scheme Public Mutual

Hi i would like to put some moneys in public mutual private retirement scheme but i have no experience on this scheme so before i proceed i would like to seek some advice from you 1.

Private retirement scheme public mutual. May i know is that any fee such as management fee or other charges required 2. Any different of the 3 funds public. Amanahraya trustees berhad public mutual prs islamic growth fund prs igrf please read the scheme s disclosure document before deciding to make a contribution. A private retirement scheme prs is an investment scheme designed to help employees and self employed workers to accumulate savings for retirement through voluntary contribution it is administered by the private pension administrator ppa whose trustees holds the prs assets for the benefit of contributors.

And the relevant fund s product highlights sheet phs before contributing. The contents in this website were prepared in good faith and the private pension administrator malaysia ppa expressly disclaims and accepts no liability whatsoever as to the accuracy relevance completeness or correctness of the information and opinion. Private retirement scheme prs is a voluntary long term contribution scheme designed to help individuals accumulate savings for retirement. The prs is a defined contribution pension scheme which allows people to voluntarily contribute into an investment vehicle for the purposes of building up their retirement fund.

How to claim that rm500 3. This is especially useful for those who wish to grow their retirement fund and invest but aren t savvy in the area of investment. Everyone deserves to look forward to a happy and financially secured retirement after many years of working. Public mutual private retirement scheme shariah based series scheme trustee.

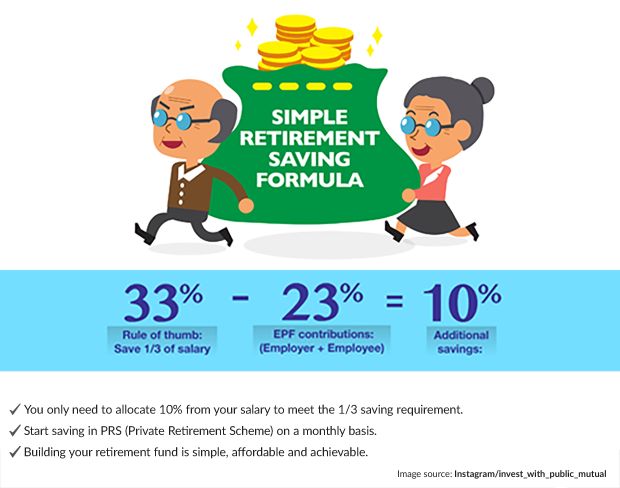

To be financially secured at retirement you will need to save adequately in order to provide 2 3 of your last drawn salary to continue the same lifestyle you have become accustomed to. Public bank also distributes a wide range of prs funds that you may choose to contribute based on your contribution time horizon risk appetite and age. You are advised to read and understand the contents of the disclosure document of public mutual private retirement scheme conventional series and disclosure document of public mutual private retirement scheme shariah based series dated 26 may 2017. Will you have enough to retire.